The function of wholesale and other time frames in the market and their impact on price action.

(How to swim next to the shark instead of into its mouth)

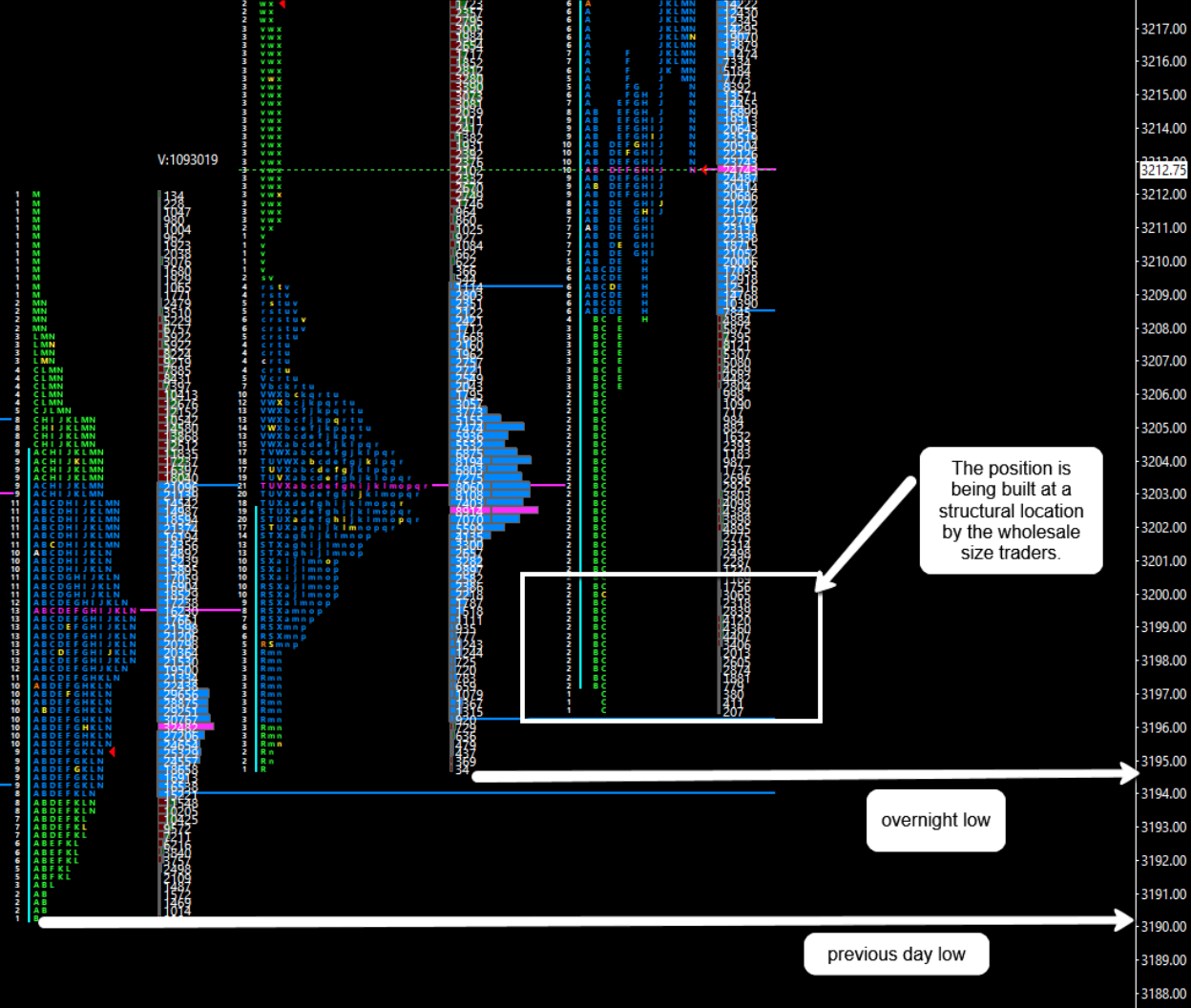

(Footprint chart provided by null_antechamber)

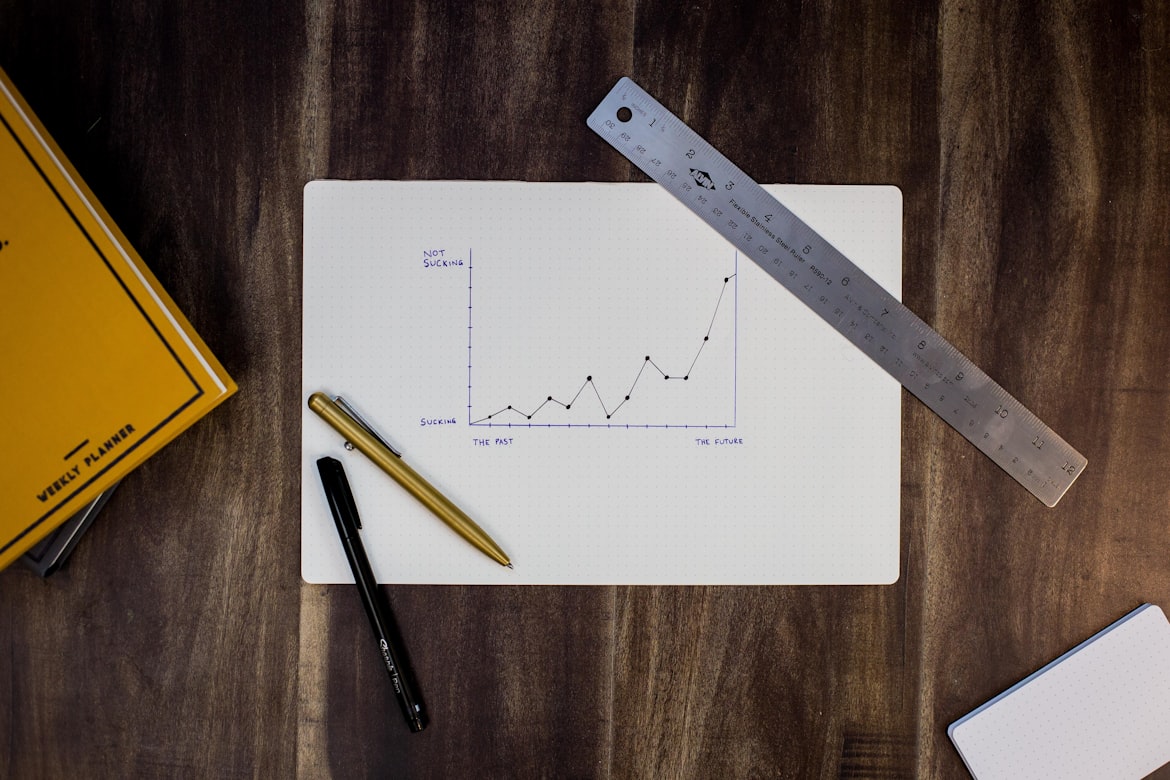

When a market is trading up and down in a narrow range this type of price action is known as “chop”. As traders, we are taught to avoid this type of price action and for good reason. By the end of this, you should have an understanding of how and why “chop” occurs and how to position yourself on the right side of the trade once the opportunity presents itself.

Let us see why this type of price action occurs and how observing it can help you trade with the size players who move price in the market.

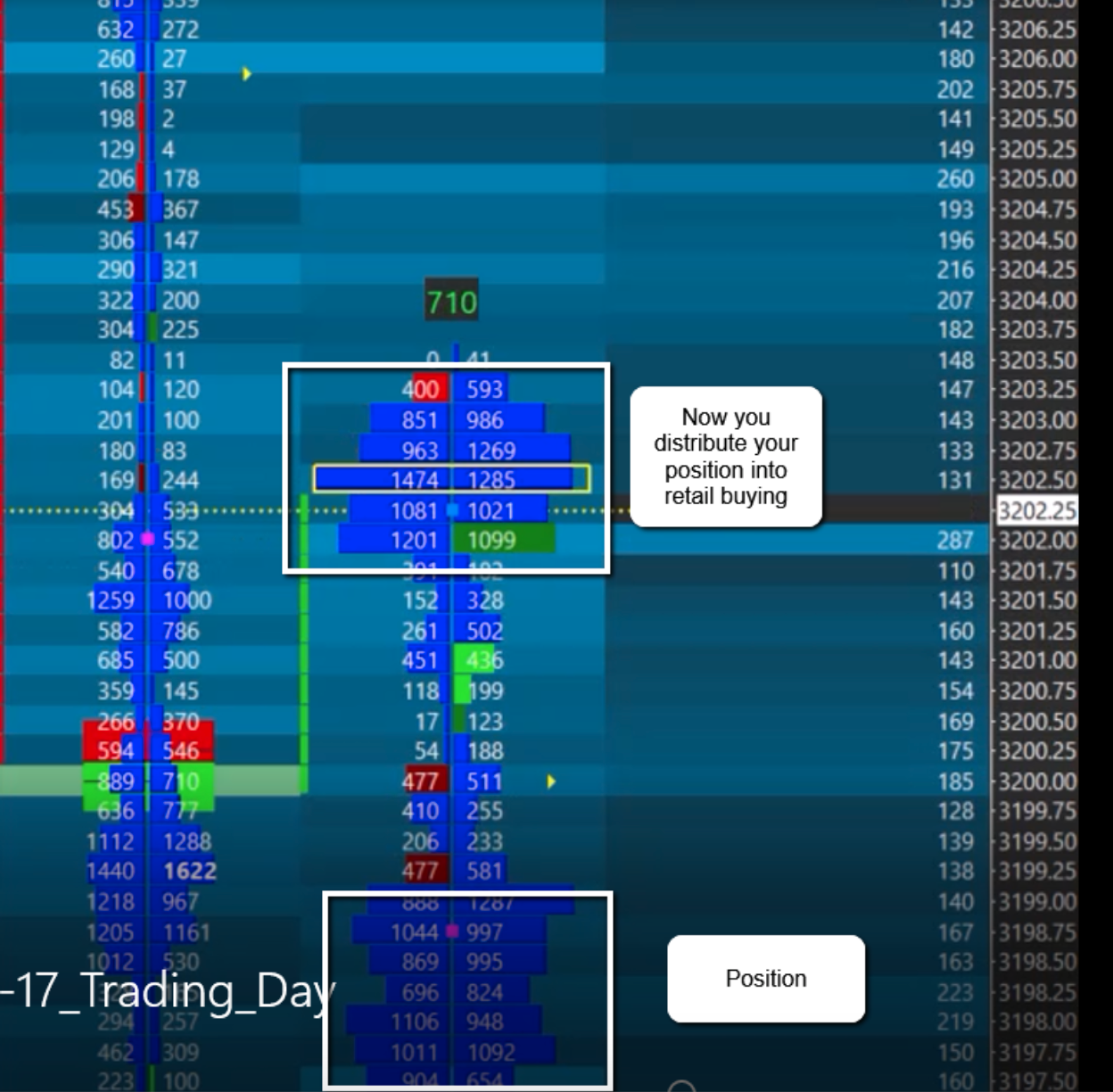

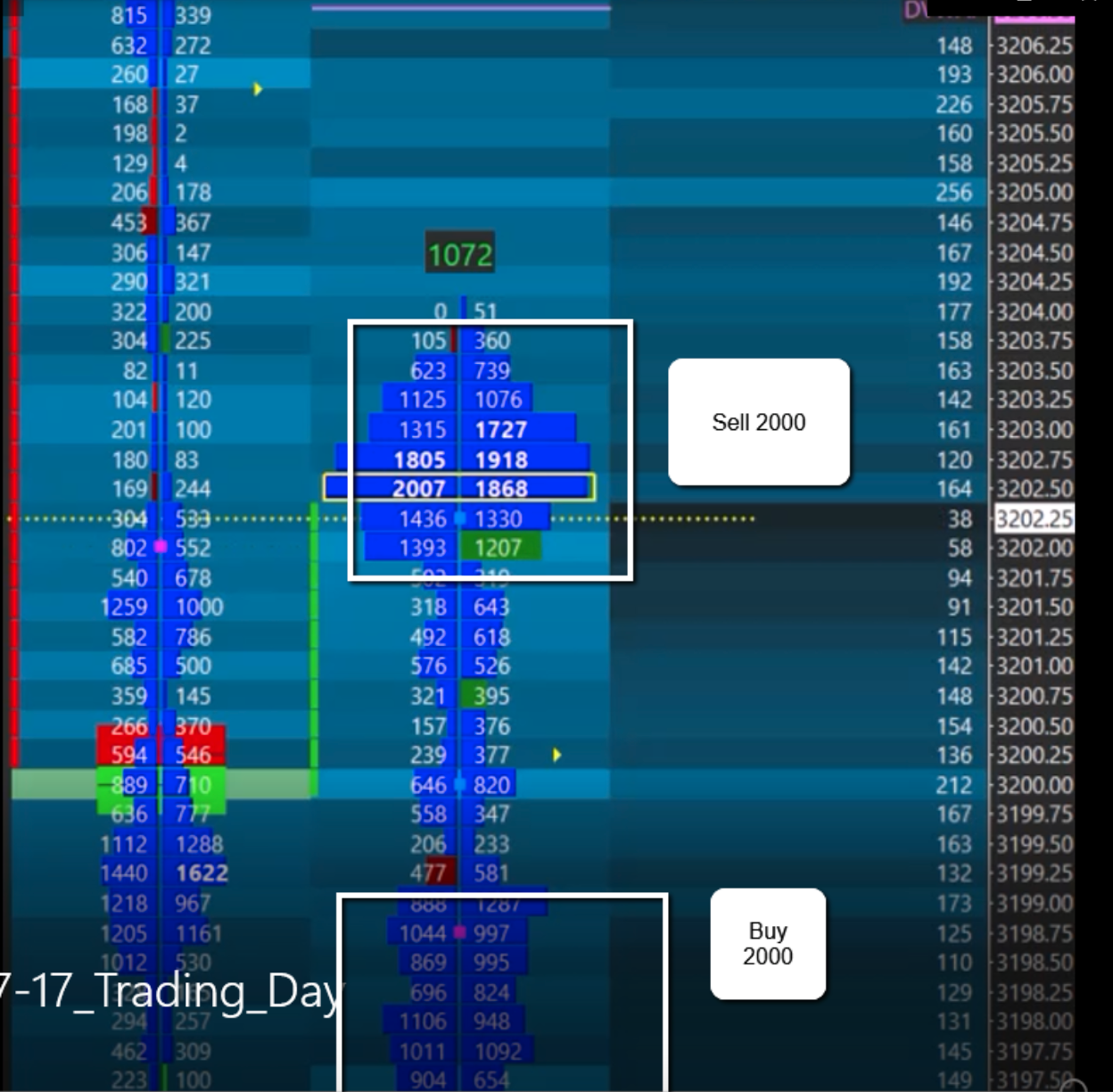

While price is moving in this up and down fashion larger timeframe players are building a position. Using the tools that we have, we can see where the position is being built and how the structural location of this position can tell you the agenda of the size traders who are building it.

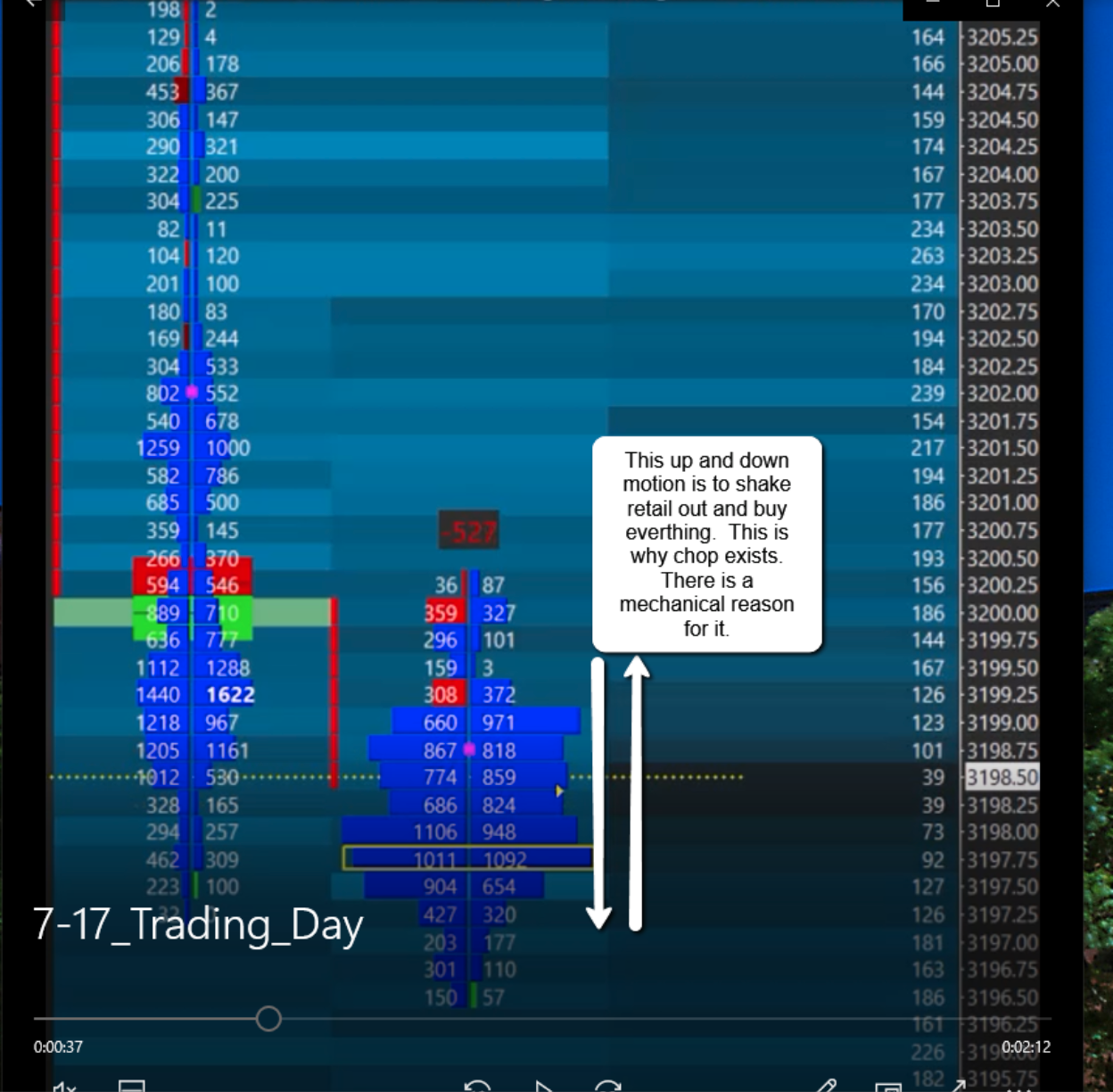

In the graphics below is the structure in question. Here is some background: before the regular trading hours (RTH) of July 17, 2020, the overnight inventory was long. At about 35 minutes into the RTH session, ES began its downwards correction as trapped longs sold out near the overnight low. At this point, price cannot break the overnight nor the previous day low. This is a huge indication that the sellers who took price down are not OTF size sellers, but rather trapped long players who are selling out or having their stops taken out.

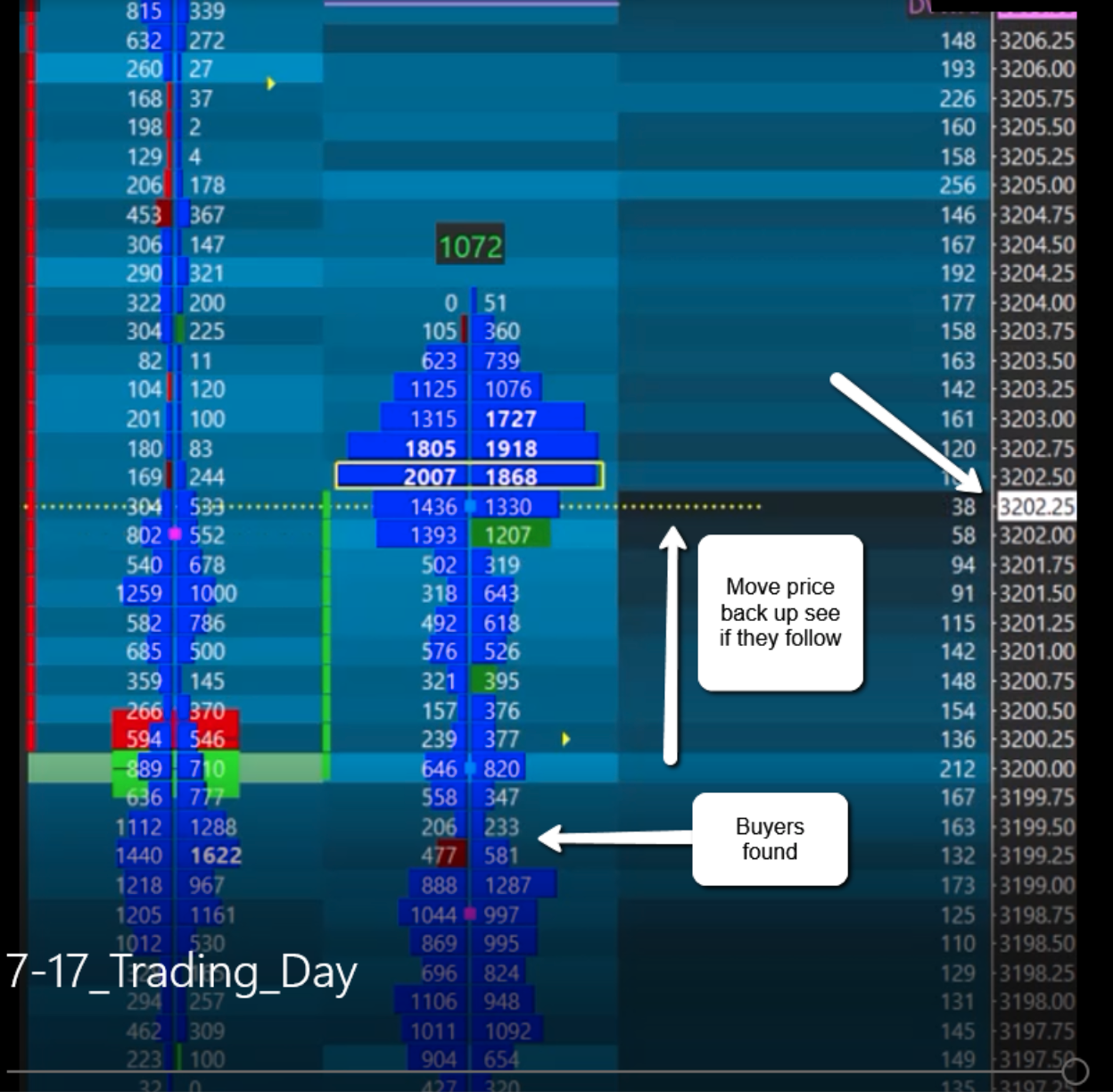

Market Profile (TPO charts) shows what business is transpiring. Now we must investigate how those size traders deal with this selling and how they later profit from it.

As the initial wave of selling starts to slow down, momentum traders see this and jump in and buy. The wholesale side of the business knows this and in order not to buy the momentum traders stock back and cut into their profits, they move bids up and down resulting in chop. (Also keep in mind when a market goes to areas like the overnight low, some traders who follow price will short here and there will be others that sell from long positions down here too.)

This order flow and the way the wholesale handles it is the mechanics of this business. By creating this back and forth price action the wholesalers are able to absorb all this selling order flow, consequently resulting in what we retail traders call CHOP.

Now we will see how the wholesalers resell this position back into retail buying as the selling subsides and is “taken into wholesale inventory” This is how the wholesaler makes their money as they provide liquidity to retail traders.

The above is the market profile which shows selling has shot off down at 3196

Trading Essays & Excerps is now sponsored by the Educational Trading Room Communities listed below

EquitiesETC Trading Room (for stocks & options trading)

Microefutures Trading Room (for ES futures & Market Profile trading)

:max_bytes(150000):strip_icc()/insurtech.asp-final-d0c67eaba6084fd1a115a21cb55768ab.png)